API Industry in India

The Active Pharmaceutical Ingredient (or API) industry is a crucial segment of the Indian pharma industry (which is anticipated to reach USD 65 billion by 2024) and contributes to around 35 per cent of the pharma market. India is the 3rd largest producer of APIs accounting for an 8 per cent share of the Global API Industry. 500+ different APIs are manufactured in India, and it contributes 57 per cent of APIs to the prequalified list of the WHO.

The growing antagonism between the West and China has also pushed the global pharma majors to source more from countries other than China. India’s emergence as the alternate source of bulk drugs has been quite remarkable.

To capitalize on its API potential, India is building a holistic and conducive ecosystem. In 2020, the government approved INR 6,940 crore for a production-linked incentive (PLI) scheme for the promotion of domestic manufacturing of Key Starting Materials (KSMs) / Drug Intermediaries (DIs), and APIs.

Over the next several years, the Indian API market is anticipated to increase at a CAGR of 13.7 per cent. The Indian API space has become lucrative for several investors and venture capitalists. India’s robust domestic market, advanced chemical industry, skilled workforce, stringent quality and manufacturing standards, and low costs (about 40 per cent less than that in the West) for setting up and operating a modern plant give an added advantage.

Consolidation in the API Industry

Strategic M&A and PE / VC investments driving consolidation in the API industry

As per a report by EY, PE/VC investments in India’s Pharma and life sciences industry have demonstrated an impressive CAGR of 24% over the last 5 years. Since 2022, the Indian Pharma and Healthcare sector has witnessed cumulative M&A deal value of USD 15 billion.

Interestingly, a big chunk of these investments have moved to the API sector where Private Equity players / asset management firms have pursued the strategy of driving consolidation through M&As, strategic investments in API companies and building API platforms. The industry has seen emergence of several large PE owned API platform companies.

Some of these platform companies include Advent International led Cohance Lifesciences / Suven Pharma, PAG & CX Partners led Sekhmet Pharmaventures, and Carlyle backed Viyash Lifesciences and Sequent Scientific (Animal API manufacturer). In addition to the PE action, the sector continues to see consolidation and divestment, the recent example being the acquisition of Glenmark Lifesciences by Nirma Industries.

Scope of the Study

The API industry continues to see robust action in the Leadership hiring space. Particularly in the Manufacturing function, while demand for senior leadership talent continues to grow, their availability is increasingly becoming less. Adding to this demand supply gap, we have also seen challenges related to increased compensation levels and age profile of senior leadership talent.

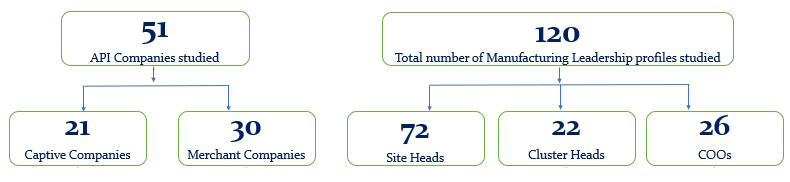

This report was put together by WalkWater Talent Advisors after an exhaustive study of manufacturing leadership talent in the API industry. The reports seeks to understand some of the key trends and talent insights which are driving leadership hiring in this function.

Research Methodology

Definitions

- Site Heads – Manufacturing leaders who are responsible for all operations in a manufacturing Site.

- Cluster Heads – Manufacturing leaders who are responsible for driving manufacturing operations across a cluster of API Sites / Plants.

- Chief Operating Officers (COO)– Leaders who are responsible for driving overall manufacturing operations across all manufacturing sites in an organization. They are reported into by Clusters Heads / multiple plant heads.

- API – API (Active Pharmaceutical Ingredient) is the biologically active component of a drug that causes an intended medical effect.

- Captive Organizations – Firms that manufacturing APIs for their in-house production needs

- Merchant Organizations – Firms that manufacture APIs to be sold to third party customers

Key findings

Inferences: One of the startling findings of our study is that there is no diversity talent across leadership levels in the manufacturing function across all company’s studied in this report.

In an era of Diversity, Equity and Inclusion, this finding is a call out to all key decision makers / influencers of this industry to urgently address this issue so that there can be better representation of diversity and a more inclusive approach to talent growth in this industry.

Inferences: Given the highly technical nature of the manufacturing roles, it is no surprise that 95% of the leadership talent pool are Chemical engineers / Chemistry Graduates by education. More over, 41% of this talent pool are full time Masters / Doctorates.

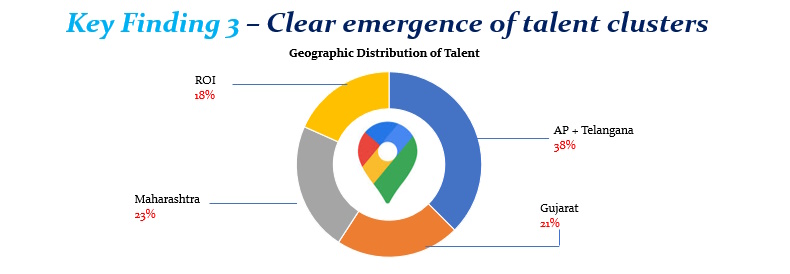

Inferences: There are 3 emerging geographic talent clusters for API manufacturing leadership talent in India – AP + Telangana is by far the largest cluster, followed by Maharashtra and Gujarat. These 3 clusters make up more than 82% of the available leadership talent in the manufacturing function and one can expect that these 3 clusters will continue to attract a major portion of planned investments in this sector.

Inferences: A 40% churn in the leadership talent is significant in any industry and given the action happening in this industry, we expect this trend to continue to grow for the next few years.

More importantly, as the industry sees continued investments leading to the manufacturing networks becoming more complex, the industry has beefed up hiring of COO candidates to provide leadership and strategic direction to manage the growth of the manufacturing operations.

Inferences: The findings suggest manufacturing leadership talent is ageing in this industry. Further as the demand supply gap widens, the industry will need to focus on better talent management strategies so that younger talent can be groomed to take up leadership responsibilities faster and more effectively.

To make up the shortage of leadership talent in the near term, companies are giving extensions to existing talent beyond their retirement age.

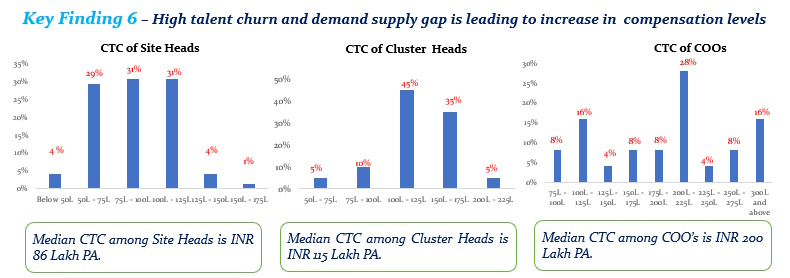

Inferences: Given the increased demand of leadership talent in the manufacturing function, compensation levels have increased in this industry and surprisingly the median CTC across levels are today comparable to CTC trends in FMCG industry for similar talent.

Cost to company (CTC) here means annual fixed + variable compensation. For critical talent, most companies also offer wealth creation opportunity through long term incentives / esops / stocks – this component is not part of the CTC figures above.

About Lead Authors

Rahul Shah

Co-Founder & Director

Rahul brings 25+ years of industry experience, out of which, he has spent more than 22 years in the Executive Search industry. Post MBA, he worked for close to 3 years with Usha Martin’s Alloy & Steels business and then moved to the Executive Search industry with ABC Consultants. He spent more than 9 years with ABC Consultants and in his last role, he was an Executive Director responsible for running the Bangalore office, the 3rd largest office by revenues.

As Co-Founder of WalkWater, he personally leads Senior Searches across sectors, with a sectoral specialization in the Consumer, Pharma and Industrial sectors.

He is an Instrumentation Engineer from Bangalore University and has completed his MBA from XIM, Bhubaneswar. He is certified in Personal Profile Analysis from Thomas International. Outside work, he is a biker and loves to travel and watch movies.

Prakash HS

Senior Vice President | Pharma & Lifesciences

Prakash brings 22+ years of work experience of which 6 years has been in Marketing and Sales in the Pharma industry and the last 16 years in the Executive Search industry with focus on leadership and niche hiring for the Pharma, Healthcare & Lifesciences segments.

He started his career in Pharma sales, subsequently joined Pfizer and had a successful stint there. Post Pfizer, he shifted to the Executive Search industry with stints in market leading companies like ABC Consultants and Korn Ferry. At WalkWater, Prakash is the sector specialist for the Pharma, Healthcare and Life science industries and has advised several MNCs and large Indian Pharma companies on critical searches and talent advisory engagements.