“If an alien came to visit, I’d be embarrassed to tell them that we fight wars to pull fossil fuels out of the ground to run our transportation.”

Neil deGrasse Tyson“Our dependence on fossil fuels amounts to global pyromania, and the only fire extinguisher we have at our disposal is renewable energy.”

Hermann Scheer

Global Outlook

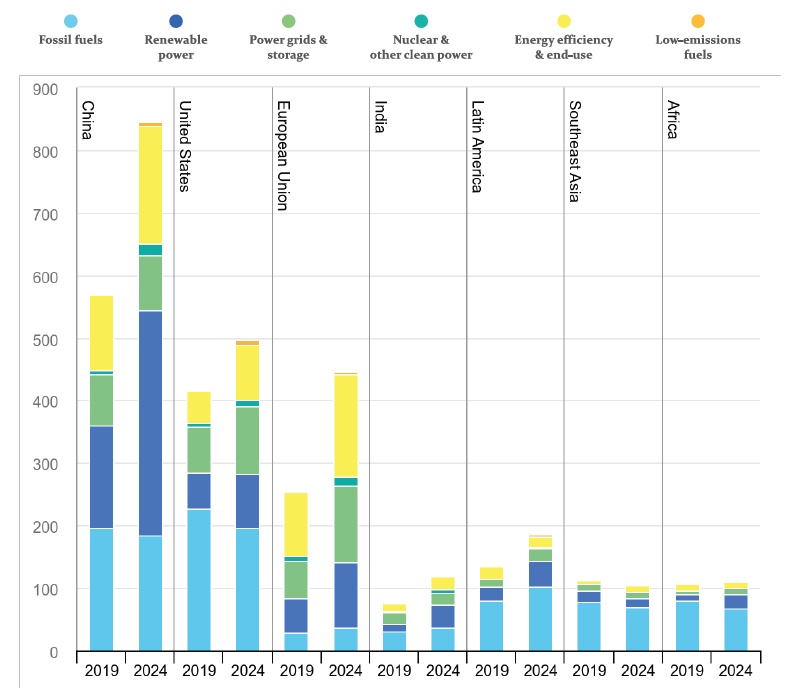

The International Energy Agency (IEA), in a May 2024 report, estimated the new investments by different countries and regions for energy generation since 2019. As per that report (refer chart below), India’s investment in fossil fuel sources increased from 30 million USD to 37 million USD, while in the same five-year period, our investment in renewable power increased more than 3x from 12 million USD to 37 million USD. While it is not envisaged that the world’s dependence on fossil fuels can disappear immediately, the worldwide shift towards renewable energy (RE) is definitive, and India is no exception.

Source : International Energy Agency

Source : International Energy Agency

India’s commitment to the world

During the Glasgow Climate Change Conference (COP26) in 2021, India conveyed its intentions to make mindful and deliberate utilization the way of life to combat climate change, instead of mindless and destructive consumption. India introduced a five-point Climate Action Plan (CAP) with specific, measurable, and time bound goals, which we christened Panchamrit. This included the intent to enhance non-fossil energy production capacity to 500 GW, meet 50% of our energy requirements from renewables, reduce carbon emissions by one billion tonnes, and reduce carbon intensity of the economy by 45%, all of these to be achieved by 2030. India also committed to NZE (net zero emissions) by 2070.

While India’s march towards becoming a $5 trillion economy continues, brave efforts are being made to decouple this from increase in greenhouse gas emissions. India has taken several policy initiatives to support the Panchamrit targets, such as the Production Linked Incentives (PLI) scheme for high-efficiency solar photovoltaic modules, Renewable Purchase Obligations and Carbon Credit Trading Scheme. The draft Electricity Amendment Act (2018) requires a minimum proportion of renewable energy to be supplied by coal/lignite based generators (renewable generation obligation RGO), and a minimum percentage of renewable energy to be purchased by discoms/supply licensees (renewable purchase obligation RPO).

The journey so far

India’s installed generation capacity in April 2024, as per the NITI Aayog, was 443 GW. Of this, just about half was from coal, oil and gas, with coal and lignite going below 50% for the first time. Solar power and wind energy were the next biggest sources, totaling a respectable 129 GW. In fact, India is now the third largest solar power generator in the world. Our total RE installed capacity is now 199.87 GW, which is 40% of our Panchamrit target already, with six more years to go. More importantly, more than 71% of the new capacity addition in FY 2023-24 was from RE sources, as per the CEEW (Council on Energy, Environment and Water).

The Indian renewable industry has been witnessing a flurry of activities in the recent past.

Here are some highlights —

The Ministry of Renewable Energy had set renewable energy bidding targets of 50 GW in FY23-24. The Solar Energy Corporation of India (SECI), NTPC, NHPC and SJVN collectively issued 53.3GW of solar, wind, hybrid and round the clock (RTC) projects.

Commercial & Industrial (C&I) segment accounts for about 40-45% share in all-India energy demand. Even assuming 20% of the energy requirements are to be met by C&I segment through renewables, the RE capacity requirement is estimated to remain significant at close to 80 GW. The segment has witnessed massive demand with a nearly 100% private participation. Regarding return on assets, equity, or capital, C&I projects yield better returns than utility-scale PPAs (Power Purchase Agreements).

Renewable captive projects have seen uptick with large Indian business houses commitment to switch to renewable energy for achieving net zero targets. Conglomerates viz Tata’s, Mahindra’s, Aditya Birla Group, JSW etc. have set up independent renewable business units.

Introduction of Approved list of Module Manufacturers (ALMM) mandated from 01st April 2024, requires solar projects awarded by central nodal agencies and state distribution utilities to source Photo Voltaic (PV) modules only from manufacturers included in the ALMM list. This gives a massive boost to Indian manufacturers to set up new plants and invest in the latest manufacturing technology. As per the latest report by MNRE, there are 83 companies in the ALMM list.

Green Hydrogen, Green Ammonia-MNRE launched the Green Hydrogen Mission in 2023 to make India the global hub for production, usage and export of Green Hydrogen & its derivatives. The initial outlay for the mission will be INR 19744 crores. Large Industrial houses viz L&T, Adani, GAIL, NTPC, Reliance, Thermax have lined up heavy investments in this space.

PV magazine — ALMM Mandate imposed Feb 13, 24

MNRE, Approved list of Module Manufacturers

The great paradox lies in the imbalance between supply and demand of talent in the industry —

The Talent Shortage!!

The leadership conundrum

Like any business sector, the critical area in the Indian renewable energy sector is leadership, and the shortage of talent looks especially pronounced in the context of the humongous growth expected in the coming years.

The renewable industry market is currently booming with a wealth of opportunities, as organizations are experiencing a significant influx of orders. This unprecedented demand is driving growth and expansion, positioning companies to capitalize on the thriving market landscape.

The trends in numbers

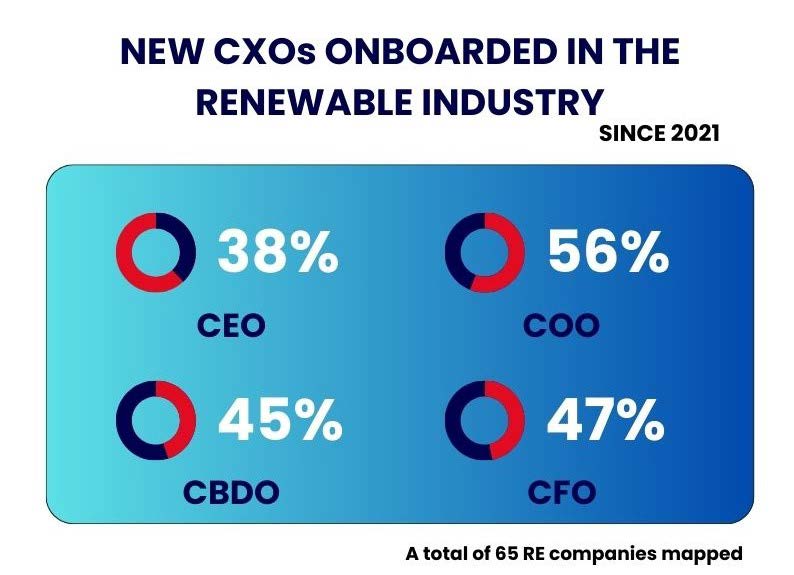

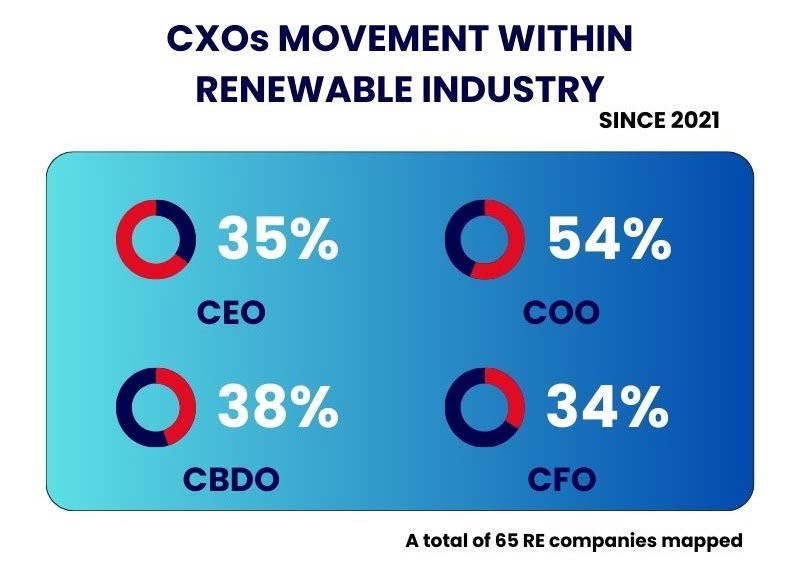

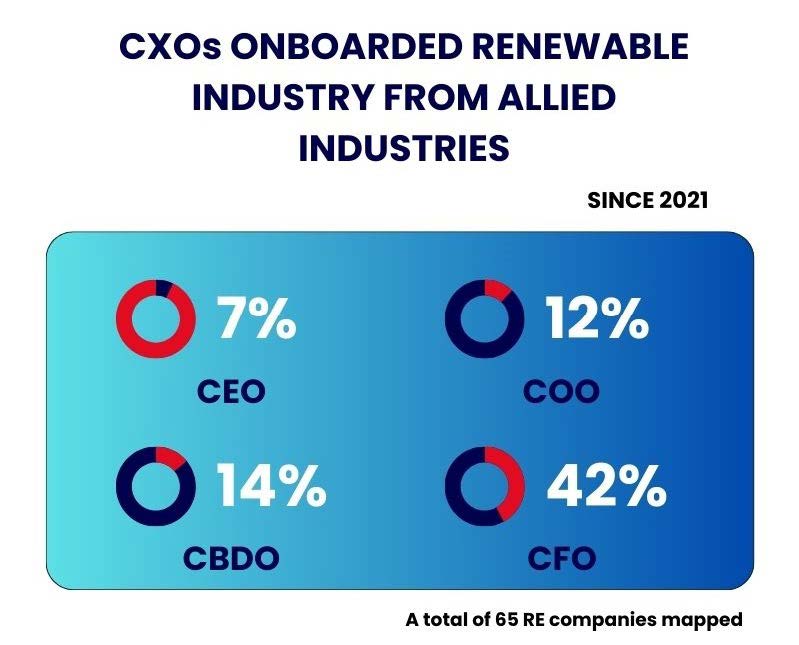

An independent study done by WalkWater, across 65 organisations, where we tracked CXO movements over the past 3 years, revealed significant trends in leadership and high impact roles that may influence the sector’s strategic direction and innovation trajectory.

Here are the key findings –

It was found that 56% of leadership hires in the renewable energy industry were COOs, followed closely by CFOs at 47% and CBDOs at 45%.

RE industry players showed a much stronger preference for talent with prior RE industry experience. The higher traction in the leadership roles indicates that organizations prefer tailor made talent.

RE industry players showed a much stronger preference for talent with prior RE industry experience. The higher traction in the leadership roles indicates that organizations prefer tailor made talent.

However, CFO movements from cross-sector were relatively high at 42%, compared to CEO (7%), COO (12%), and CBDO (14%) movements.

However, CFO movements from cross-sector were relatively high at 42%, compared to CEO (7%), COO (12%), and CBDO (14%) movements.

Comprehensive Insights

- There is a clear gap in leadership talent and organizations are often looking at talent from the same pool, leading to a noticeable shortage. This talent shortage arises from the sector’s rapid expansion outstripping the availability of skilled professionals.

- Organizations are increasingly seeking tailor-made talent and competing for a limited pool of experienced leaders. Additionally, higher attrition rates and the escalating costs of retention are compounding the challenge. This has also resulted in an unbalanced increase in salaries, disrupting the compensation parity at senior and leadership levels. This trend may become unsustainable for both candidates and companies, as candidates could become overpriced, and companies might struggle to keep up with the rising compensation demands.

- Talent in niche roles such as land acquisition, design engineering, policy & regulatory are becoming critical bottlenecks in the renewable industry. These roles are essential for the successful development & implementation of the RE projects but often face challenges such as regulatory complexities, land availability issues, grid connectivity and need for specialized technical expertise.

- The talent shortage is further exacerbated by organizations primarily hiring through references, thereby limiting their ability to tap into a broader pool of potential candidates and contributing to the overall scarcity of skilled professionals in the sector.

- Moreover, organizations are not adequately considering talent from allied industries and have no time to experiment with new talent, further limiting the talent pool. This talent scarcity poses a significant challenge for sustaining long-term success and effectively managing the increased workload.

- For relatively newer topics like Green Hydrogen, organizations often face a scarcity of relevant talent and are thus compelled to seek expertise from other allied sectors like Oil & Gas, Chemicals, Fertilizers to meet their needs.

Will the renewables sector be able to dig deep and unearth fresh leadership talent from across diverse industries? Or will this sector, true to its name, continue to reuse and regenerate existing leadership talent, with leaders moving within companies in a repetitive echo chamber?

Way Forward

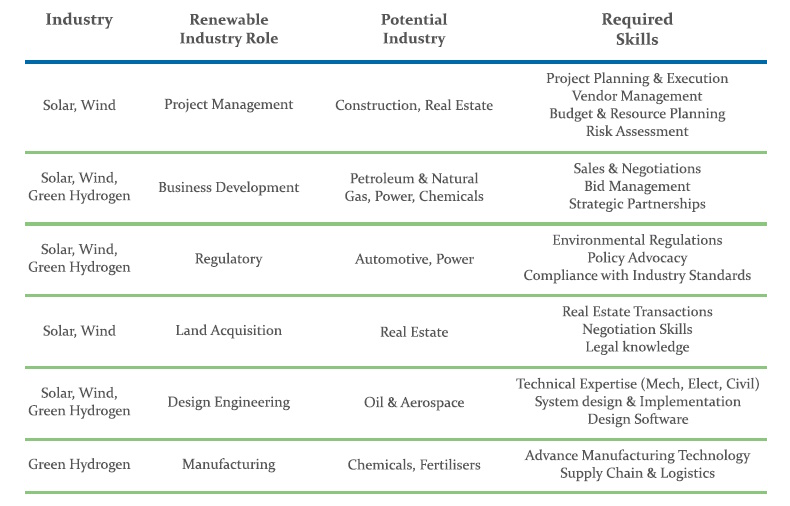

Based on our experience with CXO movements in the renewable energy industry and discussions with RE leaders, we have developed the following Industry Talent Grid Map. This talent grid is our recommendation for some of the key roles, considering their transition from various potential industries to the renewable industry.

Conclusion

India’s renewable energy sector is at a critical juncture, with ambitious targets to achieve and a significant talent shortage to overcome. While the sector has made tremendous progress, the leadership talent paradox threatens to hinder its long-term success. To sustain the momentum and achieve the Panchamrit goals, it is essential to develop and attract visionary leaders who can navigate the complex landscape of the renewable energy industry. Organizations must adopt a more inclusive approach to talent acquisition, considering candidates from cross-sector and investing in targeted leadership development programs. Moreover, industry associations and peer networks must play a crucial role in fostering a culture of knowledge sharing, collaboration, and talent exchange to address the senior executive talent gap.

About WalkWater Talent Advisors

We are a 13-year-old boutique executive search and talent advisory firm started by senior executives from the search industry —Kunal Girap, Harold D’Souza, Rahul Shah and Ashutosh Khanna. WalkWater focusses on leadership hiring across the CEO, CXO and CXO minus 1 level. Today the firm is one of the fastest growing Executive Search firms in India. Our team size is around 28 and is spread across our regional presence in 4 cities in India (Mumbai, Bangalore, Gurgaon, and Pune) apart from operations in the United States. Our work has spanned large MNCs and Indian Business houses and a whole array of start-ups / emerging companies across sectors.

About the authors

Kunal Girap

Co-Founder and Director

WalkWater Talent Advisors

kunal@walkwatertalent.com

Vidya Venkataramani

Senior Consultant

WalkWater Talent Advisors

vidya@walkwatertalent.com